Derivative Pricing_1_Black

1. Stock Option wih divends

1.1 Task A

1.1.1 Calculate a ECO on a stock.

/Ex-dividend dates in 3 and 6 months, each dividend is expected to be 1;

/P0 = 80, K = 80, σ = 0.25 per annum, rf = 0.07; T = 1;

1.1.2 Process and results:

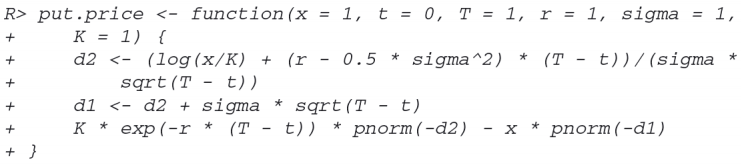

K <- 80

r <- 0.07

sigma <- 0.25

tau <- 1

# pv of expected dividends

d <- exp(-(tau/4) * r) + exp(-(tau/2) * r)

# stock price

S <- K - d

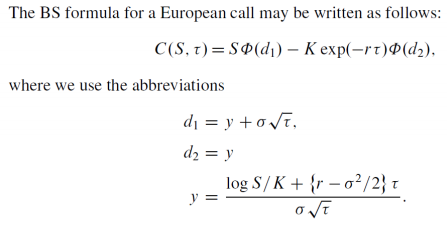

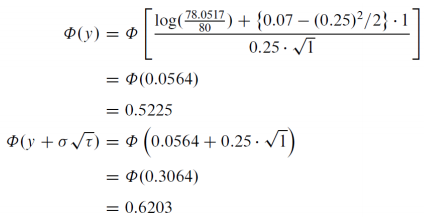

Deduct pv of dividends from S0 to arrive at purely random component of S0 which is 78.0517.

y <- (log(S/K) + (r - sigma^2 / 2) * tau) / (sigma * sqrt(tau))

cdfy <- pnorm(y)

cdfn <- pnorm(y + sigma * sqrt(tau))

# BS formula

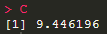

C <- S * cdfn - (K * exp(-r * tau) * cdfy)

1.2 Task B

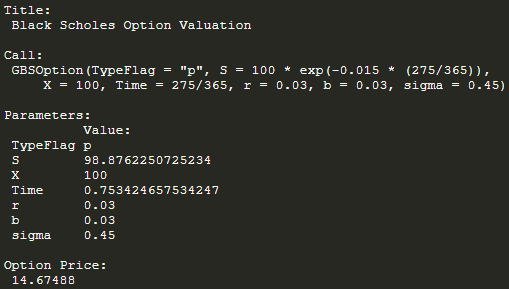

1.2.1 Calculate EPO using BSM model, assume that

/Continuously compounded dividend yield is 0.015;

/S0 = 100, K = 100, option expires in 275 days, volatility is 0.45;

/Continuously compounded rf = 0.03;

1.2.2 Process and results

# Adjust S0

GBSOption('p', 100 * exp(-0.015 * (275/365)), 100, 275/365, 0.03, 0.03, 0.45)

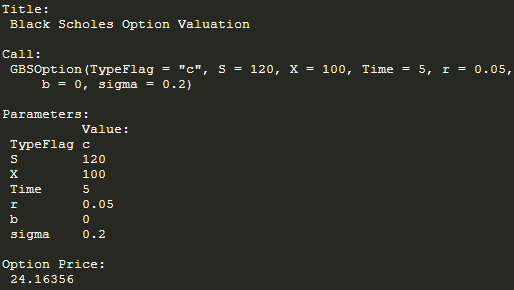

2. Black's Futures Option Model

2.1 Key parameter: S = F, b = 0;

2.2 Task: Need an option for an asset (futures price = 120), assume K = 100, T = 5, volatility = 20%, riskfree rate = 5%;

2.3 Process and results:

GBSOption('c', 120, 100, 5, 0.05, 0, 0.2)

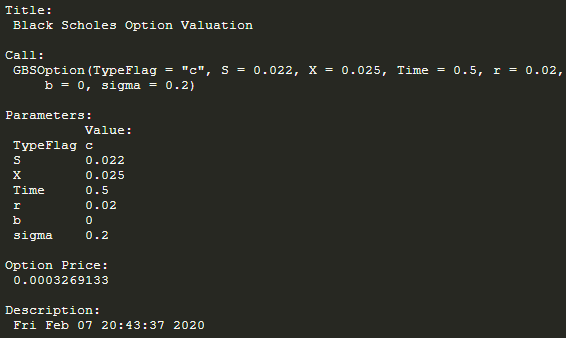

3. Pricing Cap Using Black

3.1 Key parameter: S = F(n-1), b = 0;

3.2 Notes:

Interest rate caps are interest rate derivatives, where holder receives positive payments throughout periods if interest rate exceeds certain level (strike price, K).

Interest rate floors the holder wins if interest rate below K.

3.3 Task:

Need to pay USD LIBOR for 6 months to Alex between May and Nov 2020, so use caplet avoid interest rate risk.

Assume: the caplet on LIBOR rate with 2.5% strike price (i.e., if LIBOR > 2.5%, one period payoff = 0.5 * max[3% - 2.5%, 0]);

LIBOR follows Brownian Motion with 20% volatility;

forward rate between May and Nov = 2.2%;

spot rate = 2%;

3.4 Process and results:

GBSOption('c', 0.022, 0.025, 0.5, 0.02, 0, 0.2)

3.5 Comments

3.5.1 Still need to multiply the time interval 0.5 on 0.0003269133 to get 0.0001634567, if unit is million USD, the final price of caplet will be 163USD;

3.5.2 Cap is sum of caplets !!! % LIBOR changes all the time, example above is just a single caplet calculation, below is whole method. Now assume that:

we need a cap that pays if LIBOR > 2.5% in first 3m, or if LIBOR > 2% in following 3m;

forward LIBOR rate in May~Aug is 2.1%, in Aug~Nov is 2.2%;

GBSOption('c', 0.021, 0.025, 0.25, 0.02, 0, 0.2)

GBSOption('c', 0.022, 0.02, 0.25, 0.02, 0, 0.2)

# we seperately get two prices, each of them with time interval 0.25, so final price of cap is:

0.25 * (3.743394e-05 + 0.002179862)

0.000554324

So final price of cap will be 554USD.

4. Drawing Binomial Trees for Stock Option

4.1 Key parameter: b = r;

4.2 Assume:

Stock P0 = 900, K = 950, r = 0.02, T = 3m, Volatility = 0.22

4.3 Process and results:

tree <- BinomialTreeOption(TypeFlag = 'ce', S = 900, X = 950, 1/4, 0.02, b = 0.02, sigma = 0.22, n = 3)

BinomialTreePlot(tree, dy = 1, xlab = 'Time steps', ylab = 'number of up steps', xlim = c(0, 4))

title(main = 'European Call Option')

4.4 Comment:

This is CRR Binomial model, which converges to Black. Black Pricing is as below:

Derivative Pricing_1_Black的更多相关文章

- Derivative of the softmax loss function

Back-propagation in a nerual network with a Softmax classifier, which uses the Softmax function: \[\ ...

- Derivative of Softmax Loss Function

Derivative of Softmax Loss Function A softmax classifier: \[ p_j = \frac{\exp{o_j}}{\sum_{k}\exp{o_k ...

- XVII Open Cup named after E.V. Pankratiev Stage 14, Grand Prix of Tatarstan, Sunday, April 2, 2017 Problem A. Arithmetic Derivative

题目:Problem A. Arithmetic DerivativeInput file: standard inputOutput file: standard inputTime limit: ...

- The Softmax function and its derivative

https://eli.thegreenplace.net/2016/the-softmax-function-and-its-derivative/ Eli Bendersky's website ...

- matlab 提示 Continuous sample time is not supported by discrete derivative 错误的解决办法

Simulink仿真的时候,出行错误提示:Continuous sample time is not supported by discrete derivative 中文意思是:连续采样时间不支持离 ...

- [PE484]Arithmetic Derivative

题意:对整数定义求导因子$'$:$p'=1,(ab)'=a'b+ab'$,求$\sum\limits_{i=2}^n(i,i')$ 这个求导定义得比较妙:$(p^e)'=ep^{e-1}$ 推一下就可 ...

- 【找规律】【DFS】XVII Open Cup named after E.V. Pankratiev Stage 14, Grand Prix of Tatarstan, Sunday, April 2, 2017 Problem A. Arithmetic Derivative

假设一个数有n个质因子a1,a2,..,an,那么n'=Σ(a1*a2*...*an)/ai. 打个表出来,发现一个数x,如果x'=Kx,那么x一定由K个“基础因子”组成. 这些基础因子是2^2,3^ ...

- 共变导数(Covariant Derivative)

原文链接 导数是指某一点的导数表示了某点上指定函数的变化率. 比如,要确定某物体的速度在某时刻的加速度,就取时间轴上下一时刻的一个微小增量,然后考察速度的增量和时间增量的比值.如果这个比值比较大,说明 ...

- 求导四则运算以及三角函数求导 Derivative formulas

对特定函数的求导. 1:sin(x) 对其进行求斜率.带入公式得:[ sin(x+Δx)- sin(x)]/Δx = [ sinx*cosΔx + cosx*sinΔx -sin x ]/ Δx = ...

随机推荐

- AppBar 自定义顶部导航按钮 图标、颜色 以及 TabBar 定义顶部 Tab 切换

一.Flutter AppBar 自定义顶部按钮图标.颜色 leading 在标题前面显示的一个控件,在首页通常显示应用的 logo:在其他界面通常显示为返回按钮 title 标题,通常显示为当 ...

- Tomcat部署Web项目的3种方式

一.将war包丢进webapps 这是最简单粗暴的方式:将web工程打成war,丢进tomcat/webapps目录即可,tomcat会自动解压.无需修改任何配置文件即可完成部署. 这里我准备了tom ...

- Go语言经典库使用分析——高性能可扩展 HTTP 路由 httprouter(转载)

转载自 飞雪无情的博客 Go语言(golang)的一个很大的优势,就是很容易的开发出网络后台服务,而且性能快,效率高.在开发后端HTTP网络应用服务的时候,我们需要处理很多HTTP的请求访问,比如常见 ...

- sql 中u.*什么意思

i.* i是一个表的别名,i.*是这个表的所有列,比如 select i.* from customer i; 相当于 select id,name,password from customer;

- vue调试工具vue-devtools安装及使用方法

vue调试工具vue-devtools安装及使用方法 https://www.jb51.net/article/150335.htm 本文主要介绍 vue的调试工具 vue-devtools 的安装和 ...

- dom4j递归解析XML字符串所有子节点

/** * dom4j递归解析所有子节点 * * @param childElements * @param mapEle * @return */ public Map<String, Obj ...

- Redis为什么要自己实现一个SDS

Redis是使用C语言开发的,在C语言中没有字符串这种数据类型,字符串大都是通过字符数组实现的,但是使用字符数组有以下不足: 1. 字符数组的长度都是固定,容易发生空指针2. 获取字符数组的长度的时候 ...

- Mysql安装 ----> 基于源码包安装

1)基于源码包安装MySQL [root@localhost ~]# rpm -q mysql mysql-server mariadb mairadb-server //检查有没 ...

- Python使用pyautogui控制鼠标键盘

官方文档:https://pyautogui.readthedocs.io/en/latest/# 安装pyautogui模块 在 Windows 上,不需要安装其他模块. 在 OS X 上,运行 s ...

- 计蒜客 青出于蓝胜于蓝(dfs序+树状数组)

题目描述 武当派一共有 n 人,门派内 n 人按照武功高低进行排名,武功最高的人排名第 1,次高的人排名第 2,... 武功最低的人排名 第 n.现在我们用武功的排名来给每个人标号,除了祖师爷,每个人 ...