kaggle 欺诈信用卡预测——不平衡训练样本的处理方法 综合结论就是:随机森林+过采样(直接复制或者smote后,黑白比例1:3 or 1:1)效果比较好!记得在smote前一定要先做标准化!!!其实随机森林对特征是否标准化无感,但是svm和LR就非常非常关键了

先看数据:

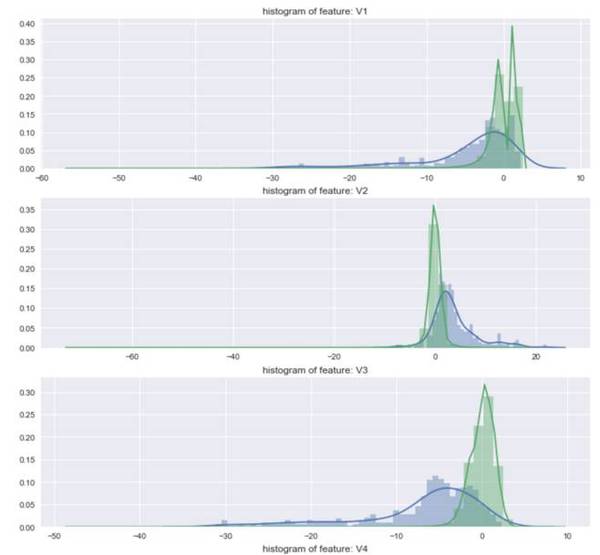

Number of seconds elapsed between each transaction (over two days)

abc

Amount of money for this transaction

Fraud or Not-Fraud

Introduction

from:https://www.kaggle.com/nikitaivanov/getting-high-sensitivity-for-imbalanced-data 主要使用了smote和聚类两种思路!

In this notebook we will try to predict fraud transactions from a given data set. Given that the data is imbalanced, standard metrics for evaluating classification algorithm (such as accuracy) are invalid. We will focus on the following metrics: Sensitivity (true positive rate) and Specificity (true negative rate). Of course, they are dependent on each other, so we want to find optimal trade-off between them. Such trade-off usually depends on the application of the algorithm, and in case of fraud detection I would prefer to see high sensitivity (e.g. given that a transaction is fraud, I want to be able to detect it with high probability).

For dealing with skewed data I am going to use SMOTE algorithm. In two words, the idea is to create synthetic samples (in opposite to oversampling with replacement) through finding nearest examples (KNN), calculating difference between them, multiplying this difference by a random number between 0 and 1 and adding the result to the initial sample. For this purpose we are going to use SMOTE function from DMwR package.

Algorithms I am going to implement are Support Vector Machine (SVM), Logistic regression and Random Forest. Models will be trained on the original and SMOTEd data and their performance will be measured on the entire data set.

As a bonus, we are going to have some fun and use K-means centroids of the negative examples together with the original positive examples as a new dataset and train our algorithm on it. We then compare results.

##Loading required packeges

library(ggplot2) #visualization

library(caret) #train model

library(dplyr) #data manipulation

library(kernlab) #svm

library(nnet) #models (logit, neural nets)

library(DMwR) #SMOTE data ##Load data

d = read.csv("../input/creditcard.csv")

n = ncol(d)

str(d)

d$Class = ifelse(d$Class == 0, 'No', 'Yes') %>% as.factor()

Loading required package: lattice

Attaching package: ‘dplyr’

The following objects are masked from ‘package:stats’:

filter, lag

The following objects are masked from ‘package:base’:

intersect, setdiff, setequal, union

Attaching package: ‘kernlab’

The following object is masked from ‘package:ggplot2’:

alpha

Loading required package: grid

'data.frame': 284807 obs. of 31 variables:

$ Time : num 0 0 1 1 2 2 4 7 7 9 ...

$ V1 : num -1.36 1.192 -1.358 -0.966 -1.158 ...

$ V2 : num -0.0728 0.2662 -1.3402 -0.1852 0.8777 ...

$ V3 : num 2.536 0.166 1.773 1.793 1.549 ...

$ V4 : num 1.378 0.448 0.38 -0.863 0.403 ...

$ V5 : num -0.3383 0.06 -0.5032 -0.0103 -0.4072 ...

$ V6 : num 0.4624 -0.0824 1.8005 1.2472 0.0959 ...

$ V7 : num 0.2396 -0.0788 0.7915 0.2376 0.5929 ...

$ V8 : num 0.0987 0.0851 0.2477 0.3774 -0.2705 ...

$ V9 : num 0.364 -0.255 -1.515 -1.387 0.818 ...

$ V10 : num 0.0908 -0.167 0.2076 -0.055 0.7531 ...

$ V11 : num -0.552 1.613 0.625 -0.226 -0.823 ...

$ V12 : num -0.6178 1.0652 0.0661 0.1782 0.5382 ...

$ V13 : num -0.991 0.489 0.717 0.508 1.346 ...

$ V14 : num -0.311 -0.144 -0.166 -0.288 -1.12 ...

$ V15 : num 1.468 0.636 2.346 -0.631 0.175 ...

$ V16 : num -0.47 0.464 -2.89 -1.06 -0.451 ...

$ V17 : num 0.208 -0.115 1.11 -0.684 -0.237 ...

$ V18 : num 0.0258 -0.1834 -0.1214 1.9658 -0.0382 ...

$ V19 : num 0.404 -0.146 -2.262 -1.233 0.803 ...

$ V20 : num 0.2514 -0.0691 0.525 -0.208 0.4085 ...

$ V21 : num -0.01831 -0.22578 0.248 -0.1083 -0.00943 ...

$ V22 : num 0.27784 -0.63867 0.77168 0.00527 0.79828 ...

$ V23 : num -0.11 0.101 0.909 -0.19 -0.137 ...

$ V24 : num 0.0669 -0.3398 -0.6893 -1.1756 0.1413 ...

$ V25 : num 0.129 0.167 -0.328 0.647 -0.206 ...

$ V26 : num -0.189 0.126 -0.139 -0.222 0.502 ...

$ V27 : num 0.13356 -0.00898 -0.05535 0.06272 0.21942 ...

$ V28 : num -0.0211 0.0147 -0.0598 0.0615 0.2152 ...

$ Amount: num 149.62 2.69 378.66 123.5 69.99 ...

$ Class : int 0 0 0 0 0 0 0 0 0 0 ...

It is always a good idea first to plot a response variable to check for skewness in data:

qplot(x = d$Class, geom = 'bar') + xlab('Fraud (Yes/No)') + ylab('Number of transactions')

Classification on the original data

Keeping in mind that the data is highly skewed we proceed. First split the data into training and test sets.

idx = createDataPartition(d$Class, p = 0.7, list = F)

d[, -n] = scale(d[, -n]) #perform scaling

train = d[idx, ]

test = d[-idx, ]

Calculate baseline accuracy for future reference

blacc = nrow(d[d$Class == 'No', ])/nrow(d)*100

cat('Baseline accuracy:', blacc)

Baseline accuracy: 99.82725

To begin with, let's train our models on the original dataset to see what we get if use unbalanced data. Due to computational limitations of my laptop, I will only run logistic regression for this purpose.

m1 = multinom(data = train, Class ~ .)

p1 = predict(m1, test[, -n], type = 'class')

cat(' Accuracy of the model', mean(p1 == test[, n])*100, '\n', 'Baseline accuracy', blacc)

# weights: 32 (31 variable)

initial value 138189.980799

final value 31315.159746

converged

Accuracy of the model 99.92744

Baseline accuracy 99.82725

Though accuracy (99.92%) of the model might look impressive at a first glance, in fact it isn't. Simply predicting 'not a fraud' for all transactions will give 99.83% accuracy. To really evaluate model's perfomance we need to check confusion matrix.

confusionMatrix(p1, test[, n], positive = 'Yes')

Confusion Matrix and Statistics

Reference

Prediction No Yes

No 85287 55

Yes 7 92

Accuracy : 0.9993

95% CI : (0.9991, 0.9994)

No Information Rate : 0.9983

P-Value [Acc > NIR] : 1.779e-15

Kappa : 0.7476

Mcnemar's Test P-Value : 2.387e-09

Sensitivity : 0.625850

Specificity : 0.999918

Pos Pred Value : 0.929293

Neg Pred Value : 0.999356

Prevalence : 0.001720

Detection Rate : 0.001077

Detection Prevalence : 0.001159

Balanced Accuracy : 0.812884

'Positive' Class : Yes

From the confusion matrix we see that while model has high accuracy (99.92%) and high specificity (99.98%), it has low sensitivity of 64%. In other words, only 64% of all fraudulent transactions were detected.

Classification on the SMOTEd data

Now let's preprocess our data using SMOTE algorithm:

table(d$Class) #check initial distribution

newData <- SMOTE(Class ~ ., d, perc.over = 500,perc.under=100)

table(newData$Class) #check SMOTed distribution

No Yes

284315 492

No Yes

2460 2952

To train SVM (with RBF kernel) we are going to use train function from caret package. It allows to choose optimal parameters of the model (cost and sigma in this case). Cost refers to penalty for misclassifying examples and sigma is a parameter of RBF which measures similarity between examples. To choose best model we use 5-fold cross-validation. We then evaluate our model on the entire data set.

gr = expand.grid(C = c(1, 50, 150), sigma = c(0.01, 0.05, 1))

tr = trainControl(method = 'cv', number = 5)

m2 = train(data = newData, Class ~ ., method = 'svmRadial', trControl = tr, tuneGrid = gr)

m2

Support Vector Machines with Radial Basis Function Kernel 5412 samples

30 predictor

2 classes: 'No', 'Yes' No pre-processing

Resampling: Cross-Validated (5 fold)

Summary of sample sizes: 4330, 4329, 4329, 4330, 4330

Resampling results across tuning parameters: C sigma Accuracy Kappa

1 0.01 0.9445668 0.8891865

1 0.05 0.9626774 0.9250408

1 1.00 0.9672934 0.9344234

50 0.01 0.9717300 0.9430408

50 0.05 0.9863262 0.9723782

50 1.00 0.9695108 0.9388440

150 0.01 0.9789351 0.9574955

150 0.05 0.9850335 0.9697552

150 1.00 0.9695108 0.9388440 Accuracy was used to select the optimal model using the largest value.

The final values used for the model were sigma = 0.05 and C = 50.

As wee see, best tuning parameters are C = 50 and sigma = 0.05

Let's look at a confusion matrix

p2 = predict(m2, d[, -n])

confusionMatrix(p2, d[, n], positive = 'Yes')

Confusion Matrix and Statistics

Reference

Prediction No Yes

No 278470 2

Yes 5845 490

Accuracy : 0.9795

95% CI : (0.9789, 0.98)

No Information Rate : 0.9983

P-Value [Acc > NIR] : 1

Kappa : 0.1408

Mcnemar's Test P-Value : <2e-16

Sensitivity : 0.995935

Specificity : 0.979442

Pos Pred Value : 0.077348

Neg Pred Value : 0.999993

Prevalence : 0.001727

Detection Rate : 0.001720

Detection Prevalence : 0.022243

Balanced Accuracy : 0.987688

'Positive' Class : Yes

(Numbers may differ due to randomness of k-fold cv)

As expected we were able to achieve sensitivity of 99.59%. In other words, out of all fraudulent transactions we correctly detected 99.59% of them. This came in price of slightly lower accuracy (in comparison to the first model) - 97.95% vs. 99.92% and lower specificity 97.94% vs. 99.98%. The main disadvantage is low level of positive predicted value (i.e. given that prediction is positive, what is probability that the true state is positive) which this case is 7.74% vs. 85% for initial (unbalanced dataset) model. As was mentioned in the beginning, one should choose a model that matches certain goals. If the goal is to correctly identify fraudulent transactions even in price of low positive predicted value (which I believe the case), then the latter model (based on SMOTed data) should be used. Looking at confusion matrix we see that almost all fraudulent transactions were correctly identified and only 2.5% were mislabeled as fraudulent.

I'm planning to try couple more models and also use more sophisticated algorithm that uses K-means centroids of the majority class as samples for non fraudulent transactions.

m3 = randomForest(data = newData, Class ~ .)

p3 = predict(m3, d[, -n])

confusionMatrix(p3, d[, n], positive = 'Yes')

Error in eval(expr, envir, enclos): could not find function "randomForest"

Traceback:

library(randomForest)

m3 = randomForest(data = newData, Class ~ .)

p3 = predict(m3, d[, -n])

confusionMatrix(p3, d[, n], positive = 'Yes')

randomForest 4.6-12

Type rfNews() to see new features/changes/bug fixes. Attaching package: ‘randomForest’ The following object is masked from ‘package:dplyr’: combine The following object is masked from ‘package:ggplot2’: margin

Confusion Matrix and Statistics

Reference

Prediction No Yes

No 282105 0

Yes 2210 492

Accuracy : 0.9922

95% CI : (0.9919, 0.9926)

No Information Rate : 0.9983

P-Value [Acc > NIR] : 1

Kappa : 0.306

Mcnemar's Test P-Value : <2e-16

Sensitivity : 1.000000

Specificity : 0.992227

Pos Pred Value : 0.182087

Neg Pred Value : 1.000000

Prevalence : 0.001727

Detection Rate : 0.001727

Detection Prevalence : 0.009487

Balanced Accuracy : 0.996113

'Positive' Class : Yes

Random forest performs really well. Sensitivity 100% and high specificity (more than 99%). All fraudulent transactions were detected and less than 1% of all transactions were falsely classified as fraud. Hence, Random Forest + SMOTE algorithm shloud be considered as final model.

K-means centroids as a new sample

For curiosity, let's take another approach in dealing with imbalanced data. We are going to separate the examples for positive and negative and from the latter one extract centroids (generated using K-means clustering). Number of clusters will be equal to the number of positive examples. We then use these centroids together with positive examples as a new sample.(思路就是聚类,将major class聚类为k个点,其中k为欺诈信用卡的样本数!)

neg = d[d$Class == 'No', ] #negative examples

pos = d[d$Class == 'Yes', ] #positive examples

n_pos = sum(d$Class == 'Yes') #calculate number of positive examples

clus = kmeans(neg[, -n], centers = n_pos, iter.max = 100) #perform K-means

neg = as.data.frame(clus$centers) #extract centroids as new sample

neg$Class = 'No'

newData = rbind(neg, pos) #merge positive and negative examples

newData$Class = factor(newData$Class)

We run random forest on the new dataset, newData, and check confusion matrix.

m4 = randomForest(data = newData, Class ~ .)

p4 = predict(m4, d[, -n])

confusionMatrix(p4, d[, n], positive = 'Yes')

Confusion Matrix and Statistics

Reference

Prediction No Yes

No 210086 0

Yes 74229 492

Accuracy : 0.7394

95% CI : (0.7378, 0.741)

No Information Rate : 0.9983

P-Value [Acc > NIR] : 1

Kappa : 0.0097

Mcnemar's Test P-Value : <2e-16

Sensitivity : 1.000000

Specificity : 0.738920

Pos Pred Value : 0.006584

Neg Pred Value : 1.000000

Prevalence : 0.001727

Detection Rate : 0.001727

Detection Prevalence : 0.262357

Balanced Accuracy : 0.869460

'Positive' Class : Yes

Well, while sensitivity is still 100%, specificity dropped to 72% leading to a big fraction of false positive predictions. Learning on the data that was transformed using SMOTE algorithm gave much better results.

from:https://www.kaggle.com/themlguy/undersample-and-oversample-approach-explored

# This Python 3 environment comes with many helpful analytics libraries installed

# It is defined by the kaggle/python docker image: https://github.com/kaggle/docker-python

# For example, here's several helpful packages to load in import numpy as np # linear algebra

import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv) # Input data files are available in the "../input/" directory.

# For example, running this (by clicking run or pressing Shift+Enter) will list the files in the input directory import os

print(os.listdir("../input")) # Any results you write to the current directory are saved as output.

['creditcard.csv']

import matplotlib.pyplot as plt

from sklearn.cross_validation import train_test_split

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import GridSearchCV

from sklearn.svm import SVC

from sklearn.ensemble import RandomForestClassifier

from sklearn.preprocessing import StandardScaler

import seaborn as sns

from sklearn.metrics import confusion_matrix,recall_score,precision_recall_curve,auc,roc_curve,roc_auc_score,classification_report

/opt/conda/lib/python3.6/site-packages/sklearn/cross_validation.py:41: DeprecationWarning: This module was deprecated in version 0.18 in favor of the model_selection module into which all the refactored classes and functions are moved. Also note that the interface of the new CV iterators are different from that of this module. This module will be removed in 0.20.

"This module will be removed in 0.20.", DeprecationWarning)

creditcard_data=pd.read_csv("../input/creditcard.csv")

creditcard_data['Amount']=StandardScaler().fit_transform(creditcard_data['Amount'].values.reshape(-1, 1))

creditcard_data.drop(['Time'], axis=1, inplace=True)

def generatePerformanceReport(clf,X_train,y_train,X_test,y_test,bool_):

if bool_==True:

clf.fit(X_train,y_train.values.ravel())

pred=clf.predict(X_test)

cnf_matrix=confusion_matrix(y_test,pred)

tn, fp, fn, tp=cnf_matrix.ravel()

print('---------------------------------')

print('Length of training data:',len(X_train))

print('Length of test data:', len(X_test))

print('---------------------------------')

print('True positives:',tp)

print('True negatives:',tn)

print('False positives:',fp)

print('False negatives:',fn)

#sns.heatmap(cnf_matrix,cmap="coolwarm_r",annot=True,linewidths=0.5)

print('----------------------Classification report--------------------------')

print(classification_report(y_test,pred))

#generate 50%, 66%, 75% proportions of normal indices to be combined with fraud indices 也就是说采样后的黑白样本比例是:0.5,0.66,0.75

#undersampled data

normal_indices=creditcard_data[creditcard_data['Class']==0].index

fraud_indices=creditcard_data[creditcard_data['Class']==1].index

for i in range(1,4):

normal_sampled_data=np.array(np.random.choice(normal_indices, i*len(fraud_indices),replace=False)) #a random sample is generated from normal_indices 主要是随机欠采样

undersampled_data=np.concatenate([fraud_indices, normal_sampled_data])

undersampled_data=creditcard_data.iloc[undersampled_data]

print('length of undersampled data ', len(undersampled_data))

print('% of fraud transactions in undersampled data ',len(undersampled_data.loc[undersampled_data['Class']==1])/len(undersampled_data))

#get feature and label data

feature_data=undersampled_data.loc[:,undersampled_data.columns!='Class']

label_data=undersampled_data.loc[:,undersampled_data.columns=='Class']

X_train, X_test, y_train, y_test=train_test_split(feature_data,label_data,test_size=0.30)

for j in [LogisticRegression(),SVC(),RandomForestClassifier(n_estimators=100)]:

clf=j

print(j)

generatePerformanceReport(clf,X_train,y_train,X_test,y_test,True)

#the above code classifies X_test which is part of undersampled data

#now, let us consider the remaining rows of dataset and use that as test set

remaining_indices=[i for i in creditcard_data.index if i not in undersampled_data.index]

testdf=creditcard_data.iloc[remaining_indices]

testdf_label=creditcard_data.loc[:,testdf.columns=='Class']

testdf_feature=creditcard_data.loc[:,testdf.columns!='Class']

generatePerformanceReport(clf,X_train,y_train,testdf_feature,testdf_label,False)

length of undersampled data 984

% of fraud transactions in undersampled data 0.5

LogisticRegression(C=1.0, class_weight=None, dual=False, fit_intercept=True,

intercept_scaling=1, max_iter=100, multi_class='ovr', n_jobs=1,

penalty='l2', random_state=None, solver='liblinear', tol=0.0001,

verbose=0, warm_start=False)

---------------------------------

Length of training data: 688

Length of test data: 296

---------------------------------

True positives: 144

True negatives: 134

False positives: 11

False negatives: 7

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 0.92 0.94 145

1 0.93 0.95 0.94 151 avg / total 0.94 0.94 0.94 296 ---------------------------------

Length of training data: 688

Length of test data: 284807

---------------------------------

True positives: 461

True negatives: 270879

False positives: 13436

False negatives: 31

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.95 0.98 284315

1 0.03 0.94 0.06 492 #可以看到LR在测试数据集上表现并不好 avg / total 1.00 0.95 0.97 284807 SVC(C=1.0, cache_size=200, class_weight=None, coef0=0.0,

decision_function_shape='ovr', degree=3, gamma='auto', kernel='rbf',

max_iter=-1, probability=False, random_state=None, shrinking=True,

tol=0.001, verbose=False)

---------------------------------

Length of training data: 688

Length of test data: 296

---------------------------------

True positives: 144

True negatives: 140

False positives: 5

False negatives: 7

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 0.97 0.96 145

1 0.97 0.95 0.96 151 avg / total 0.96 0.96 0.96 296 ---------------------------------

Length of training data: 688

Length of test data: 284807

---------------------------------

True positives: 463

True negatives: 267084

False positives: 17231

False negatives: 29

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.94 0.97 284315

1 0.03 0.94 0.05 492 #看来svm在测试数据集上也不行啊 avg / total 1.00 0.94 0.97 284807 RandomForestClassifier(bootstrap=True, class_weight=None, criterion='gini',

max_depth=None, max_features='auto', max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, n_estimators=100, n_jobs=1,

oob_score=False, random_state=None, verbose=0,

warm_start=False)

---------------------------------

Length of training data: 688

Length of test data: 296

---------------------------------

True positives: 144

True negatives: 142

False positives: 3

False negatives: 7

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 0.98 0.97 145

1 0.98 0.95 0.97 151 avg / total 0.97 0.97 0.97 296 ---------------------------------

Length of training data: 688

Length of test data: 284807

---------------------------------

True positives: 485

True negatives: 275060

False positives: 9255

False negatives: 7

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.97 0.98 284315

1 0.05 0.99 0.09 492 #Rf也不行???? avg / total 1.00 0.97 0.98 284807 length of undersampled data 1476

% of fraud transactions in undersampled data 0.3333333333333333

LogisticRegression(C=1.0, class_weight=None, dual=False, fit_intercept=True,

intercept_scaling=1, max_iter=100, multi_class='ovr', n_jobs=1,

penalty='l2', random_state=None, solver='liblinear', tol=0.0001,

verbose=0, warm_start=False)

---------------------------------

Length of training data: 1033

Length of test data: 443

---------------------------------

True positives: 130

True negatives: 291

False positives: 5

False negatives: 17

----------------------Classification report--------------------------

precision recall f1-score support 0 0.94 0.98 0.96 296

1 0.96 0.88 0.92 147 avg / total 0.95 0.95 0.95 443 ---------------------------------

Length of training data: 1033

Length of test data: 284807

---------------------------------

True positives: 442

True negatives: 278887

False positives: 5428

False negatives: 50

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.98 0.99 284315

1 0.08 0.90 0.14 492 avg / total 1.00 0.98 0.99 284807 SVC(C=1.0, cache_size=200, class_weight=None, coef0=0.0,

decision_function_shape='ovr', degree=3, gamma='auto', kernel='rbf',

max_iter=-1, probability=False, random_state=None, shrinking=True,

tol=0.001, verbose=False)

---------------------------------

Length of training data: 1033

Length of test data: 443

---------------------------------

True positives: 133

True negatives: 286

False positives: 10

False negatives: 14

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 0.97 0.96 296

1 0.93 0.90 0.92 147 avg / total 0.95 0.95 0.95 443 ---------------------------------

Length of training data: 1033

Length of test data: 284807

---------------------------------

True positives: 453

True negatives: 274909

False positives: 9406

False negatives: 39

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.97 0.98 284315

1 0.05 0.92 0.09 492 avg / total 1.00 0.97 0.98 284807 RandomForestClassifier(bootstrap=True, class_weight=None, criterion='gini',

max_depth=None, max_features='auto', max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, n_estimators=100, n_jobs=1,

oob_score=False, random_state=None, verbose=0,

warm_start=False)

---------------------------------

Length of training data: 1033

Length of test data: 443

---------------------------------

True positives: 128

True negatives: 293

False positives: 3

False negatives: 19

----------------------Classification report--------------------------

precision recall f1-score support 0 0.94 0.99 0.96 296

1 0.98 0.87 0.92 147 avg / total 0.95 0.95 0.95 443 ---------------------------------

Length of training data: 1033

Length of test data: 284807

---------------------------------

True positives: 473

True negatives: 281560

False positives: 2755

False negatives: 19

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.99 1.00 284315

1 0.15 0.96 0.25 492 avg / total 1.00 0.99 0.99 284807 length of undersampled data 1968

% of fraud transactions in undersampled data 0.25

LogisticRegression(C=1.0, class_weight=None, dual=False, fit_intercept=True,

intercept_scaling=1, max_iter=100, multi_class='ovr', n_jobs=1,

penalty='l2', random_state=None, solver='liblinear', tol=0.0001,

verbose=0, warm_start=False)

---------------------------------

Length of training data: 1377

Length of test data: 591

---------------------------------

True positives: 116

True negatives: 451

False positives: 5

False negatives: 19

----------------------Classification report--------------------------

precision recall f1-score support 0 0.96 0.99 0.97 456

1 0.96 0.86 0.91 135 avg / total 0.96 0.96 0.96 591 ---------------------------------

Length of training data: 1377

Length of test data: 284807

---------------------------------

True positives: 433

True negatives: 282245

False positives: 2070

False negatives: 59

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.99 1.00 284315

1 0.17 0.88 0.29 492 avg / total 1.00 0.99 1.00 284807 SVC(C=1.0, cache_size=200, class_weight=None, coef0=0.0,

decision_function_shape='ovr', degree=3, gamma='auto', kernel='rbf',

max_iter=-1, probability=False, random_state=None, shrinking=True,

tol=0.001, verbose=False)

---------------------------------

Length of training data: 1377

Length of test data: 591

---------------------------------

True positives: 118

True negatives: 447

False positives: 9

False negatives: 17

----------------------Classification report--------------------------

precision recall f1-score support 0 0.96 0.98 0.97 456

1 0.93 0.87 0.90 135 avg / total 0.96 0.96 0.96 591 ---------------------------------

Length of training data: 1377

Length of test data: 284807

---------------------------------

True positives: 445

True negatives: 279369

False positives: 4946

False negatives: 47

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.98 0.99 284315

1 0.08 0.90 0.15 492 avg / total 1.00 0.98 0.99 284807 RandomForestClassifier(bootstrap=True, class_weight=None, criterion='gini',

max_depth=None, max_features='auto', max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, n_estimators=100, n_jobs=1,

oob_score=False, random_state=None, verbose=0,

warm_start=False)

---------------------------------

Length of training data: 1377

Length of test data: 591

---------------------------------

True positives: 112

True negatives: 455

False positives: 1

False negatives: 23

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 1.00 0.97 456

1 0.99 0.83 0.90 135 avg / total 0.96 0.96 0.96 591 ---------------------------------

Length of training data: 1377

Length of test data: 284807

---------------------------------

True positives: 469

True negatives: 283466

False positives: 849

False negatives: 23

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 1.00 1.00 284315

1 0.36 0.95 0.52 492 avg / total 1.00 1.00 1.00 284807 整体来看,因为欠采样只是用了一个模型,因此预测效果很差!!!因为没有用到全量数据特征,所以在全部数据集上表现并不好!

#oversampled_data data

normal_sampled_indices=creditcard_data.loc[creditcard_data['Class']==0].index

oversampled_data=creditcard_data.iloc[normal_sampled_indices]

fraud_data=creditcard_data.loc[creditcard_data['Class']==1]

oversampled_data=oversampled_data.append([fraud_data]*300, ignore_index=True) #此处过采样处理是直接将欺诈样本复制300份!!!

print('length of oversampled_data data ', len(oversampled_data))

print('% of fraud transactions in oversampled_data data ',len(oversampled_data.loc[oversampled_data['Class']==1])/len(oversampled_data))

#get feature and label data

feature_data=oversampled_data.loc[:,oversampled_data.columns!='Class']

label_data=oversampled_data.loc[:,oversampled_data.columns=='Class']

X_train, X_test, y_train, y_test=train_test_split(feature_data,label_data,test_size=0.30)

for j in [LogisticRegression(),RandomForestClassifier(n_estimators=100)]:

clf=j

print(j)

generatePerformanceReport(clf,X_train,y_train,X_test,y_test,True)

#the above code classifies X_test which is part of undersampled data

#now, let us consider the remaining rows of dataset and use that as test set

remaining_indices=[i for i in creditcard_data.index if i not in oversampled_data.index]

testdf=creditcard_data.iloc[remaining_indices]

testdf_label=creditcard_data.loc[:,testdf.columns=='Class']

testdf_feature=creditcard_data.loc[:,testdf.columns!='Class']

generatePerformanceReport(clf,X_train,y_train,testdf_feature,testdf_label,False)

length of oversampled_data data 431915

% of fraud transactions in oversampled_data data 0.3417339059768704 最后复制后的欺诈样本比例为白样本的33%

LogisticRegression(C=1.0, class_weight=None, dual=False, fit_intercept=True,

intercept_scaling=1, max_iter=100, multi_class='ovr', n_jobs=1,

penalty='l2', random_state=None, solver='liblinear', tol=0.0001,

verbose=0, warm_start=False)

---------------------------------

Length of training data: 302340

Length of test data: 129575

---------------------------------

True positives: 39803

True negatives: 84311

False positives: 1027

False negatives: 4434

----------------------Classification report--------------------------

precision recall f1-score support 0 0.95 0.99 0.97 85338

1 0.97 0.90 0.94 44237 avg / total 0.96 0.96 0.96 129575 ---------------------------------

Length of training data: 302340

Length of test data: 284807

---------------------------------

True positives: 444

True negatives: 281055

False positives: 3260

False negatives: 48

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 0.99 0.99 284315

1 0.12 0.90 0.21 492 #效果也不咋的啊! avg / total 1.00 0.99 0.99 284807 RandomForestClassifier(bootstrap=True, class_weight=None, criterion='gini',

max_depth=None, max_features='auto', max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, n_estimators=100, n_jobs=1,

oob_score=False, random_state=None, verbose=0,

warm_start=False)

---------------------------------

Length of training data: 302340

Length of test data: 129575

---------------------------------

True positives: 44237

True negatives: 85327

False positives: 11

False negatives: 0

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 1.00 1.00 85338

1 1.00 1.00 1.00 44237 avg / total 1.00 1.00 1.00 129575 ---------------------------------

Length of training data: 302340

Length of test data: 284807

---------------------------------

True positives: 492

True negatives: 284304

False positives: 11

False negatives: 0

----------------------Classification report--------------------------

precision recall f1-score support 0 1.00 1.00 1.00 284315

1 0.98 1.00 0.99 492 #随机森林还是不错的!!! avg / total 1.00 1.00 1.00 284807

Random forest classifier with oversampled approach performs better compared to undersampled approach!!!

from:https://www.kaggle.com/gargmanish/how-to-handle-imbalance-data-study-in-detail

Hi all as we know credit card fraud detection will have a imbalanced data i.e having more number of normal class than the number of fraud class

In this I will use Basic method of handling imbalance data which are

This all I have done by using Analytics Vidya's blog please find the link Analytics Vidya

Undersampling:- it means taking the less number of majority class (In our case taking less number of Normal transactions so that our new data will be balanced

Oversampling: it means using replicating the data of minority class (fraud class) so that we can have a balanced data

SMOTE: it is also a type of oversampling but in this we will make the synthetic example of Minority data and will give as a balanced data

First I will start with the Undersampling and will try to classify using these Models

Decision Tree Classifier/ Random Forest Classifier

Logistic regression

SVM

XGboost

# This Python 3 environment comes with many helpful analytics libraries installed

# It is defined by the kaggle/python docker image: https://github.com/kaggle/docker-python

# For example, here's several helpful packages to load in import numpy as np # linear algebra

import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv) # Input data files are available in the "../input/" directory.

# For example, running this (by clicking run or pressing Shift+Enter) will list the files in the input directory from subprocess import check_output

print(check_output(["ls", "../input"]).decode("utf8")) # Any results you write to the current directory are saved as output.

creditcard.csv

Lets start with Importing Libraries and data

import pandas as pd # to import csv and for data manipulation

import matplotlib.pyplot as plt # to plot graph

import seaborn as sns # for intractve graphs

import numpy as np # for linear algebra

import datetime # to dela with date and time

%matplotlib inline

from sklearn.preprocessing import StandardScaler # for preprocessing the data

from sklearn.ensemble import RandomForestClassifier # Random forest classifier

from sklearn.tree import DecisionTreeClassifier # for Decision Tree classifier

from sklearn.svm import SVC # for SVM classification

from sklearn.linear_model import LogisticRegression

from sklearn.cross_validation import train_test_split # to split the data

from sklearn.cross_validation import KFold # For cross vbalidation

from sklearn.model_selection import GridSearchCV # for tunnig hyper parameter it will use all combination of given parameters

from sklearn.model_selection import RandomizedSearchCV # same for tunning hyper parameter but will use random combinations of parameters

from sklearn.metrics import confusion_matrix,recall_score,precision_recall_curve,auc,roc_curve,roc_auc_score,classification_report

import warnings

warnings.filterwarnings('ignore')

/opt/conda/lib/python3.6/site-packages/sklearn/cross_validation.py:43: DeprecationWarning: This module was deprecated in version 0.18 in favor of the model_selection module into which all the refactored classes and functions are moved. Also note that the interface of the new CV iterators are different from that of this module. This module will be removed in 0.20.

"This module will be removed in 0.20.", DeprecationWarning)

data = pd.read_csv("../input/creditcard.csv",header = 0)

Now explore the data to get insight in it

data.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 284807 entries, 0 to 284806

Data columns (total 31 columns):

Time 284807 non-null float64

V1 284807 non-null float64

V2 284807 non-null float64

V3 284807 non-null float64

V4 284807 non-null float64

V5 284807 non-null float64

V6 284807 non-null float64

V7 284807 non-null float64

V8 284807 non-null float64

V9 284807 non-null float64

V10 284807 non-null float64

V11 284807 non-null float64

V12 284807 non-null float64

V13 284807 non-null float64

V14 284807 non-null float64

V15 284807 non-null float64

V16 284807 non-null float64

V17 284807 non-null float64

V18 284807 non-null float64

V19 284807 non-null float64

V20 284807 non-null float64

V21 284807 non-null float64

V22 284807 non-null float64

V23 284807 non-null float64

V24 284807 non-null float64

V25 284807 non-null float64

V26 284807 non-null float64

V27 284807 non-null float64

V28 284807 non-null float64

Amount 284807 non-null float64

Class 284807 non-null int64

dtypes: float64(30), int64(1)

memory usage: 67.4 MB

- Hence we can see there are 284,807 rows and 31 columns which is a huge data

- Time is also in float here mean it can be only seconds starting from a particular time

# Now lets check the class distributions

sns.countplot("Class",data=data)

<matplotlib.axes._subplots.AxesSubplot at 0x7f6dabaaf128>

- As we know data is imbalanced and this graph also confirmed it

# now let us check in the number of Percentage

Count_Normal_transacation = len(data[data["Class"]==0]) # normal transaction are repersented by 0

Count_Fraud_transacation = len(data[data["Class"]==1]) # fraud by 1

Percentage_of_Normal_transacation = Count_Normal_transacation/(Count_Normal_transacation+Count_Fraud_transacation)

print("percentage of normal transacation is",Percentage_of_Normal_transacation*100)

Percentage_of_Fraud_transacation= Count_Fraud_transacation/(Count_Normal_transacation+Count_Fraud_transacation)

print("percentage of fraud transacation",Percentage_of_Fraud_transacation*100)

percentage of normal transacation is 99.82725143693798

percentage of fraud transacation 0.1727485630620034

- Hence in data there is only 0.17 % are the fraud transcation while 99.83 are valid transcation

- So now we have to do resampling of this data

- before doing resampling lets have look at the amount related to valid transcation and fraud transcation

Fraud_transacation = data[data["Class"]==1]

Normal_transacation= data[data["Class"]==0]

plt.figure(figsize=(10,6))

plt.subplot(121)

Fraud_transacation.Amount.plot.hist(title="Fraud Transacation")

plt.subplot(122)

Normal_transacation.Amount.plot.hist(title="Normal Transaction")

<matplotlib.axes._subplots.AxesSubplot at 0x7f6da691cf60>

# the distribution for Normal transction is not clear and it seams that all transaction are less than 2.5 K

# So plot graph for same

Fraud_transacation = data[data["Class"]==1]

Normal_transacation= data[data["Class"]==0]

plt.figure(figsize=(10,6))

plt.subplot(121)

Fraud_transacation[Fraud_transacation["Amount"]<= 2500].Amount.plot.hist(title="Fraud Tranascation")

plt.subplot(122)

Normal_transacation[Normal_transacation["Amount"]<=2500].Amount.plot.hist(title="Normal Transaction")

<matplotlib.axes._subplots.AxesSubplot at 0x7f6d98ecb0f0>

- Here now after exploring data we can say there is no pattern in data

- Now lets start with resmapling of data

ReSampling - Under Sampling

Before re sampling lets have look at the different accuracy matrices

Accuracy = TP+TN/Total

Precison = TP/(TP+FP)

Recall = TP/(TP+FN)

TP = True possitive means no of possitve cases which are predicted possitive

TN = True negative means no of negative cases which are predicted negative

FP = False possitve means no of negative cases which are predicted possitive

FN= False Negative means no of possitive cases which are predicted negative

Now for our case recall will be a better option because in these case no of normal transacations will be very high than the no of fraud cases and sometime a fraud case will be predicted as normal. So, recall will give us a sense of only fraud cases

Resampling

in this we will resample our data with different size

then we will try to use this resampled data to train our model

then we will use this model to predict for our original data

# for undersampling we need a portion of majority class and will take whole data of minority class

# count fraud transaction is the total number of fraud transaction

# now lets us see the index of fraud cases

fraud_indices= np.array(data[data.Class==1].index)

normal_indices = np.array(data[data.Class==0].index)

#now let us a define a function for make undersample data with different proportion

#different proportion means with different proportion of normal classes of data

def undersample(normal_indices,fraud_indices,times):#times denote the normal data = times*fraud data

Normal_indices_undersample = np.array(np.random.choice(normal_indices,(times*Count_Fraud_transacation),replace=False)) #和上面例子是一样的!!!

undersample_data= np.concatenate([fraud_indices,Normal_indices_undersample])

undersample_data = data.iloc[undersample_data,:] print("the normal transacation proportion is :",len(undersample_data[undersample_data.Class==0])/len(undersample_data[undersample_data.Class]))

print("the fraud transacation proportion is :",len(undersample_data[undersample_data.Class==1])/len(undersample_data[undersample_data.Class]))

print("total number of record in resampled data is:",len(undersample_data[undersample_data.Class]))

return(undersample_data)

## first make a model function for modeling with confusion matrix

def model(model,features_train,features_test,labels_train,labels_test):

clf= model

clf.fit(features_train,labels_train.values.ravel())

pred=clf.predict(features_test)

cnf_matrix=confusion_matrix(labels_test,pred)

print("the recall for this model is :",cnf_matrix[1,1]/(cnf_matrix[1,1]+cnf_matrix[1,0]))

fig= plt.figure(figsize=(6,3))# to plot the graph

print("TP",cnf_matrix[1,1,]) # no of fraud transaction which are predicted fraud

print("TN",cnf_matrix[0,0]) # no. of normal transaction which are predited normal

print("FP",cnf_matrix[0,1]) # no of normal transaction which are predicted fraud

print("FN",cnf_matrix[1,0]) # no of fraud Transaction which are predicted normal

sns.heatmap(cnf_matrix,cmap="coolwarm_r",annot=True,linewidths=0.5)

plt.title("Confusion_matrix")

plt.xlabel("Predicted_class")

plt.ylabel("Real class")

plt.show()

print("\n----------Classification Report------------------------------------")

print(classification_report(labels_test,pred))

def data_prepration(x): # preparing data for training and testing as we are going to use different data

#again and again so make a function

x_features= x.ix[:,x.columns != "Class"]

x_labels=x.ix[:,x.columns=="Class"]

x_features_train,x_features_test,x_labels_train,x_labels_test = train_test_split(x_features,x_labels,test_size=0.3) #30%用于测试

print("length of training data")

print(len(x_features_train))

print("length of test data")

print(len(x_features_test))

return(x_features_train,x_features_test,x_labels_train,x_labels_test)

# before starting we should standridze our ampount column

data["Normalized Amount"] = StandardScaler().fit_transform(data['Amount'].reshape(-1, 1))

data.drop(["Time","Amount"],axis=1,inplace=True)

data.head()

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | ... | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Class | Normalized Amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | -1.359807 | -0.072781 | 2.536347 | 1.378155 | -0.338321 | 0.462388 | 0.239599 | 0.098698 | 0.363787 | 0.090794 | ... | -0.018307 | 0.277838 | -0.110474 | 0.066928 | 0.128539 | -0.189115 | 0.133558 | -0.021053 | 0 | 0.244964 |

| 1 | 1.191857 | 0.266151 | 0.166480 | 0.448154 | 0.060018 | -0.082361 | -0.078803 | 0.085102 | -0.255425 | -0.166974 | ... | -0.225775 | -0.638672 | 0.101288 | -0.339846 | 0.167170 | 0.125895 | -0.008983 | 0.014724 | 0 | -0.342475 |

| 2 | -1.358354 | -1.340163 | 1.773209 | 0.379780 | -0.503198 | 1.800499 | 0.791461 | 0.247676 | -1.514654 | 0.207643 | ... | 0.247998 | 0.771679 | 0.909412 | -0.689281 | -0.327642 | -0.139097 | -0.055353 | -0.059752 | 0 | 1.160686 |

| 3 | -0.966272 | -0.185226 | 1.792993 | -0.863291 | -0.010309 | 1.247203 | 0.237609 | 0.377436 | -1.387024 | -0.054952 | ... | -0.108300 | 0.005274 | -0.190321 | -1.175575 | 0.647376 | -0.221929 | 0.062723 | 0.061458 | 0 | 0.140534 |

| 4 | -1.158233 | 0.877737 | 1.548718 | 0.403034 | -0.407193 | 0.095921 | 0.592941 | -0.270533 | 0.817739 | 0.753074 | ... | -0.009431 | 0.798278 | -0.137458 | 0.141267 | -0.206010 | 0.502292 | 0.219422 | 0.215153 | 0 | -0.073403 |

5 rows × 30 columns

Logistic Regression with Undersample Data

# Now make undersample data with differnt portion

# here i will take normal trasaction in 0..5 %, 0.66% and 0.75 % proportion of total data now do this for

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

print()

clf=LogisticRegression()

model(clf,undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test)

print("________________________________________________________________________________________________________") # here 1st proportion conatain 50% normal transaction

#Proportion 2nd contains 66% noraml transaction

#proportion 3rd contains 75 % normal transaction

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296 the recall for this model is : 0.897260273973

TP 131

TN 147

FP 3

FN 15

----------Classification Report------------------------------------

precision recall f1-score support 0 0.91 0.98 0.94 150

1 0.98 0.90 0.94 146 #测试集上???咋会这么高!!! avg / total 0.94 0.94 0.94 296 ________________________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443 the recall for this model is : 0.929078014184

TP 131

TN 296

FP 6

FN 10

----------Classification Report------------------------------------

precision recall f1-score support 0 0.97 0.98 0.97 302

1 0.96 0.93 0.94 141 avg / total 0.96 0.96 0.96 443 ________________________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591 the recall for this model is : 0.892086330935

TP 124

TN 446

FP 6

FN 15

----------Classification Report------------------------------------

precision recall f1-score support 0 0.97 0.99 0.98 452

1 0.95 0.89 0.92 139 avg / total 0.96 0.96 0.96 591 ________________________________________________________________________________________________________

- As the number of normal transaction is increasing the recall for fraud transcation is decreasing

- TP = no of fraud transaction which are predicted fraud

- TN = no. of normal transaction which are predicted normal

- FP = no of normal transaction which are predicted fraud

- FN =no of fraud Transaction which are predicted normal

#let us train this model using undersample data and test for the whole data test set #用欠采样训练的模型来预测全量数据集

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

data_features_train,data_features_test,data_labels_train,data_labels_test=data_prepration(data)

#the partion for whole data

print()

clf=LogisticRegression()

model(clf,undersample_features_train,data_features_test,undersample_labels_train,data_labels_test)

# here training for the undersample data but tatsing for whole data

print("_________________________________________________________________________________________")

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296

length of training data

199364

length of test data

85443 the recall for this model is : 0.923076923077

TP 132

TN 81568

FP 3732

FN 11

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.96 0.98 85300

1 0.03 0.92 0.07 143 #果然是预测全量数据不好!!! avg / total 1.00 0.96 0.98 85443 _________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443

length of training data

199364

length of test data

85443 the recall for this model is : 0.913333333333

TP 137

TN 84232

FP 1061

FN 13

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.99 0.99 85293

1 0.11 0.91 0.20 150 avg / total 1.00 0.99 0.99 85443 _________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591

length of training data

199364

length of test data

85443 the recall for this model is : 0.894366197183

TP 127

TN 84750

FP 551

FN 15

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.99 1.00 85301

1 0.19 0.89 0.31 142 avg / total 1.00 0.99 1.00 85443 _________________________________________________________________________________________

Here we can see it is following same recall pattern as it was for under sample data that's sounds good but if we have look at the precision is very less

So we should built a model which is correct overall

Precision is less means we are predicting other class wrong like as for our third part there were 953 transaction are predicted fraud it means we and recall is good then it means we are catching fraud transaction very well but we are catching innocent transaction also i.e which are not fraud.

So with recall our precision should be better

if we go by this model then we are going to put 953 innocents in jail with the all criminal who have actually done this

- Hence we are mainly lacking in the precision how can we increase our precision

- Don't get confuse with above output showing that the two training data and two test data first one is for undersample data while another one is for our whole data

1.Try with SVM and then Random Forest in same Manner

- from Random forest we can get which features are more important

SVM with Undersample data

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

print()

clf= SVC()# here we are just changing classifier

model(clf,undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test)

print("________________________________________________________________________________________________________")

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296 the recall for this model is : 0.933734939759

TP 155

TN 117

FP 13

FN 11

----------Classification Report------------------------------------

precision recall f1-score support 0 0.91 0.90 0.91 130

1 0.92 0.93 0.93 166 avg / total 0.92 0.92 0.92 296 ________________________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443 the recall for this model is : 0.923076923077

TP 120

TN 302

FP 11

FN 10

----------Classification Report------------------------------------

precision recall f1-score support 0 0.97 0.96 0.97 313

1 0.92 0.92 0.92 130 avg / total 0.95 0.95 0.95 443 ________________________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591 the recall for this model is : 0.858974358974

TP 134

TN 428

FP 7

FN 22

----------Classification Report------------------------------------

precision recall f1-score support 0 0.95 0.98 0.97 435

1 0.95 0.86 0.90 156 avg / total 0.95 0.95 0.95 591 ________________________________________________________________________________________________________

Here recall and precision are approximately equal to Logistic Regression

Lets try for whole data

#let us train this model using undersample data and test for the whole data test set

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

data_features_train,data_features_test,data_labels_train,data_labels_test=data_prepration(data)

#the partion for whole data

print()

clf=SVC()

model(clf,undersample_features_train,data_features_test,undersample_labels_train,data_labels_test)

# here training for the undersample data but tatsing for whole data

print("_________________________________________________________________________________________")

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296

length of training data

199364

length of test data

85443 the recall for this model is : 0.941176470588

TP 128

TN 81207

FP 4100

FN 8

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.95 0.98 85307

1 0.03 0.94 0.06 136 avg / total 1.00 0.95 0.97 85443 _________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443

length of training data

199364

length of test data

85443 the recall for this model is : 0.922580645161

TP 143

TN 82552

FP 2736

FN 12

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.97 0.98 85288

1 0.05 0.92 0.09 155 avg / total 1.00 0.97 0.98 85443 _________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591

length of training data

199364

length of test data

85443 the recall for this model is : 0.888888888889

TP 136

TN 83261

FP 2029

FN 17

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.98 0.99 85290

1 0.06 0.89 0.12 153 avg / total 1.00 0.98 0.99 85443 _________________________________________________________________________________________

- A better recall but precision is not improving much

2 .so to improve precision we must have to tune the hyper parameter of these models

3 That I will do in next version

4 For now lets try with my favorite Random Forest classifier

# Random Forest Classifier with undersample data only

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

print()

clf= RandomForestClassifier(n_estimators=100)# here we are just changing classifier

model(clf,undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test)

print("________________________________________________________________________________________________________")

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296 the recall for this model is : 0.858064516129

TP 133

TN 139

FP 2

FN 22

----------Classification Report------------------------------------

precision recall f1-score support 0 0.86 0.99 0.92 141

1 0.99 0.86 0.92 155 avg / total 0.93 0.92 0.92 296 ________________________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443 the recall for this model is : 0.890410958904

TP 130

TN 294

FP 3

FN 16

----------Classification Report------------------------------------

precision recall f1-score support 0 0.95 0.99 0.97 297

1 0.98 0.89 0.93 146 avg / total 0.96 0.96 0.96 443 ________________________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591 the recall for this model is : 0.863636363636

TP 133

TN 436

FP 1

FN 21

----------Classification Report------------------------------------

precision recall f1-score support 0 0.95 1.00 0.98 437

1 0.99 0.86 0.92 154 avg / total 0.96 0.96 0.96 591 ________________________________________________________________________________________________________

#let us train this model using undersample data and test for the whole data test set

for i in range(1,4):

print("the undersample data for {} proportion".format(i))

print()

Undersample_data = undersample(normal_indices,fraud_indices,i)

print("------------------------------------------------------------")

print()

print("the model classification for {} proportion".format(i))

print()

undersample_features_train,undersample_features_test,undersample_labels_train,undersample_labels_test=data_prepration(Undersample_data)

data_features_train,data_features_test,data_labels_train,data_labels_test=data_prepration(data)

#the partion for whole data

print()

clf=RandomForestClassifier(n_estimators=100)

model(clf,undersample_features_train,data_features_test,undersample_labels_train,data_labels_test)

# here training for the undersample data but tatsing for whole data

print("_________________________________________________________________________________________")

the undersample data for 1 proportion the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

------------------------------------------------------------ the model classification for 1 proportion length of training data

688

length of test data

296

length of training data

199364

length of test data

85443 the recall for this model is : 0.971631205674

TP 137

TN 83064

FP 2238

FN 4

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.97 0.99 85302

1 0.06 0.97 0.11 141 avg / total 1.00 0.97 0.99 85443 _________________________________________________________________________________________

the undersample data for 2 proportion the normal transacation proportion is : 0.6666666666666666

the fraud transacation proportion is : 0.3333333333333333

total number of record in resampled data is: 1476

------------------------------------------------------------ the model classification for 2 proportion length of training data

1033

length of test data

443

length of training data

199364

length of test data

85443 the recall for this model is : 0.967320261438

TP 148

TN 84448

FP 842

FN 5

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 0.99 1.00 85290

1 0.15 0.97 0.26 153 avg / total 1.00 0.99 0.99 85443 _________________________________________________________________________________________

the undersample data for 3 proportion the normal transacation proportion is : 0.75

the fraud transacation proportion is : 0.25

total number of record in resampled data is: 1968

------------------------------------------------------------ the model classification for 3 proportion length of training data

1377

length of test data

591

length of training data

199364

length of test data

85443 the recall for this model is : 0.967948717949

TP 151

TN 84964

FP 323

FN 5

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 1.00 1.00 85287

1 0.32 0.97 0.48 156 avg / total 1.00 1.00 1.00 85443 _________________________________________________________________________________________

for the third proportion the precision is 0.33 which is better than others

Lets try to get only import features using Random Forest Classifier

After it i will do analysis only for one portion that is 0.5 %

featimp = pd.Series(clf.feature_importances_,index=data_features_train.columns).sort_values(ascending=False)

print(featimp) # this is the property of Random Forest classifier that it provide us the importance

# of the features use

V14 0.206364

V10 0.134424

V11 0.098375

V12 0.097194

V17 0.088706

V4 0.075658

V3 0.071006

V16 0.034599

V2 0.020407

V18 0.019018

V7 0.017165

V21 0.014312

V27 0.011712

V19 0.011044

V8 0.010244

V1 0.008564

Normalized Amount 0.007908

V9 0.007183

V20 0.007094

V15 0.006852

V26 0.006653

V5 0.006597

V22 0.006507

V13 0.005839

V24 0.005519

V28 0.005390

V6 0.005303

V25 0.005210

V23 0.005154

dtype: float64

we can see this is showing the importance of feature for the making decision

V14 is having a very good importance compare to other features

Lets use only top 5 (V14,V10,V12,V17,V4) feature to predict using Random forest classifier only for 0.5 % 特征选择使用top 5特征

# make a new data with only class and V14

data1=data[["V14","V10","V12","V17","V4","Class"]]

data1.head()

| V14 | V10 | V12 | V17 | V4 | Class | |

|---|---|---|---|---|---|---|

| 0 | -0.311169 | 0.090794 | -0.617801 | 0.207971 | 1.378155 | 0 |

| 1 | -0.143772 | -0.166974 | 1.065235 | -0.114805 | 0.448154 | 0 |

| 2 | -0.165946 | 0.207643 | 0.066084 | 1.109969 | 0.379780 | 0 |

| 3 | -0.287924 | -0.054952 | 0.178228 | -0.684093 | -0.863291 | 0 |

| 4 | -1.119670 | 0.753074 | 0.538196 | -0.237033 | 0.403034 | 0 |

Undersample_data1 = undersample(normal_indices,fraud_indices,1)

#only for 50 % proportion it means normal transaction and fraud transaction are equal so passing

Undersample_data1_features_train,Undersample_data1_features_test,Undersample_data1_labels_train,Undersample_data1_labels_test = data_prepration(Undersample_data1)

the normal transacation proportion is : 0.5

the fraud transacation proportion is : 0.5

total number of record in resampled data is: 984

length of training data

688

length of test data

296

clf= RandomForestClassifier(n_estimators=100)

model(clf,Undersample_data1_features_train,Undersample_data1_features_test,Undersample_data1_labels_train,Undersample_data1_labels_test)

the recall for this model is : 0.93006993007

TP 133

TN 149

FP 4

FN 10

----------Classification Report------------------------------------

precision recall f1-score support 0 0.94 0.97 0.96 153

1 0.97 0.93 0.95 143 avg / total 0.95 0.95 0.95 296

Over Sampling

In my previous version I got the 100 recall and 98 % precision by using Random forest with the over sampled data but in real it was due to over fitting because i was taking whole fraud data and was training for that and I was doing the testing on the same data.

Please find link of previous version for more understanding Link

- Thanks to Mr. Dominik Stuerzer for help

# now we will divied our data sets into two part and we will train and test and will oversample the train data and predict for test data

# lets import data again

data = pd.read_csv("../input/creditcard.csv",header = 0)

print("length of training data",len(data))

print("length of normal data",len(data[data["Class"]==0]))

print("length of fraud data",len(data[data["Class"]==1]))

length of training data 284807

length of normal data 284315

length of fraud data 492

data_train_X,data_test_X,data_train_y,data_test_y=data_prepration(data)

data_train_X.columns

data_train_y.columns

length of training data

199364

length of test data

85443

Index(['Class'], dtype='object')

# ok Now we have a traing data

data_train_X["Class"]= data_train_y["Class"] # combining class with original data

data_train = data_train_X.copy() # for naming conevntion

print("length of training data",len(data_train))

# Now make data set of normal transction from train data

normal_data = data_train[data_train["Class"]==0]

print("length of normal data",len(normal_data))

fraud_data = data_train[data_train["Class"]==1]

print("length of fraud data",len(fraud_data))

length of training data 199364

length of normal data 199009

length of fraud data 355

# Now start oversamoling of training data

# means we will duplicate many times the value of fraud data #直接复制365份!!!

for i in range (365): # the number is choosen by myself on basis of nnumber of fraud transaction

normal_data= normal_data.append(fraud_data)

os_data = normal_data.copy()

print("length of oversampled data is ",len(os_data))

print("Number of normal transcation in oversampled data",len(os_data[os_data["Class"]==0]))

print("No.of fraud transcation",len(os_data[os_data["Class"]==1]))

print("Proportion of Normal data in oversampled data is ",len(os_data[os_data["Class"]==0])/len(os_data))

print("Proportion of fraud data in oversampled data is ",len(os_data[os_data["Class"]==1])/len(os_data))

length of oversampled data is 328584

Number of normal transcation in oversampled data 199009

No.of fraud transcation 129575

Proportion of Normal data in oversampled data is 0.6056563922771651

Proportion of fraud data in oversampled data is 0.39434360772283494

- The proportion now becomes the 60 % and 40 % that is good now

# before applying any model standerdize our data amount

os_data["Normalized Amount"] = StandardScaler().fit_transform(os_data['Amount'].reshape(-1, 1))

os_data.drop(["Time","Amount"],axis=1,inplace=True) 其实随机森林对特征是否标准化无感,但是svm和LR就非常非常关键了

os_data.head()

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | ... | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Class | Normalized Amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 82656 | 1.356574 | -1.535896 | 1.014585 | -0.980949 | -1.840651 | 0.495094 | -1.535552 | 0.235415 | -0.847601 | 1.180545 | ... | -0.578444 | -0.948479 | 0.038288 | -0.051798 | 0.350549 | -0.338308 | 0.073518 | 0.017247 | 0 | -0.240655 |

| 202761 | 0.078384 | 0.693709 | -0.282273 | -1.007720 | 1.058216 | -0.035670 | 0.838345 | 0.070423 | -0.094317 | -0.221217 | ... | -0.303203 | -0.775385 | -0.086534 | -1.414806 | -0.360046 | 0.208073 | 0.234031 | 0.072388 | 0 | -0.371265 |

| 85985 | -3.549282 | -3.403880 | 2.389801 | 1.080311 | 1.683676 | -1.100104 | -0.699287 | 0.171644 | 0.935805 | -0.256182 | ... | -0.284722 | 0.428109 | 2.844650 | 0.006528 | 0.466552 | 0.421108 | 0.260494 | -0.472237 | 0 | -0.383217 |

| 215180 | 2.084961 | 0.009129 | -3.842413 | -0.551511 | 3.139773 | 2.743495 | 0.130580 | 0.552759 | -0.030368 | -0.295843 | ... | 0.034740 | 0.187883 | -0.014668 | 0.682901 | 0.410981 | 0.734260 | -0.081080 | -0.064606 | 0 | -0.374769 |

| 75855 | 1.193268 | -0.071682 | 0.611175 | -0.232721 | -0.478724 | -0.216029 | -0.329775 | 0.071921 | 0.009225 | -0.112748 | ... | -0.043944 | -0.080370 | 0.101692 | 0.090155 | 0.041104 | 0.914386 | -0.053130 | -0.002135 | 0 | -0.388278 |

5 rows × 30 columns

# Now use this oversampled data for trainig the model and predict value for the test data that we created before

# now let us try within the the oversampled data itself

# for that we need to split our oversampled data into train and test

# so call our function data Prepration with oversampled data

os_train_X,os_test_X,os_train_y,os_test_y=data_prepration(os_data)

clf= RandomForestClassifier(n_estimators=100)

model(clf,os_train_X,os_test_X,os_train_y,os_test_y)

length of training data

230008

length of test data

98576

the recall for this model is : 1.0

TP 38975

TN 59596

FP 5

FN 0

----------Classification Report------------------------------------

precision recall f1-score support 0 1.00 1.00 1.00 59601

1 1.00 1.00 1.00 38975 avg / total 1.00 1.00 1.00 98576

Observations

- As it have too many sample of same fraud data so may be the all which are present in train data are present in test data also so we can say it is over fitting #重复样本太多,过拟合严重

- So lets try with test data that one which we created in starting of oversampling segment no fraud transaction from that data have been repeated here #在过采样前先拿出一点数据出来做测试,而不是过采样之后!!!

- Lets try

# now take all over sampled data as trainging and test it for test data

os_data_X = os_data.ix[:,os_data.columns != "Class"]

os_data_y = os_data.ix[:,os_data.columns == "Class"]

#for that we have to standrdize the normal amount and drop the time from it

data_test_X["Normalized Amount"] = StandardScaler().fit_transform(data_test_X['Amount'].reshape(-1, 1))

data_test_X.drop(["Time","Amount"],axis=1,inplace=True)

data_test_X.head()

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | ... | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Normalized Amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|